Introduction

Federal Union credit is depository institutions as any other financial institution they work as a financial intermediary and they perform as a bridge between lenders and consumers of funds. Federal union credits are essentially performing two tasks first they are organized like any cooperative lending institution so they are organized around a community consisting of either employees of a federal department or residents of a certain area so they acquire funds by issuing shares or any other kind of deposits and then like any other commercial banks the federal union credit lends funds to consumers (who are also its members) and earn by getting a certain interest rate as specified by rules given in the constitution for federal union credit. The detail about federal union credit is given below.

Detail

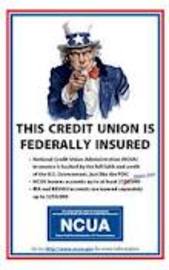

The federal union credit members are provided with safe option for savings and borrow at reasonable rates. The savings in federal union credit is insured upto $250,000 by the National Credit union Share Insurance funds (NCUSIF). Another important thing to know is that Federal union Credit is owned by its own share holders who are its own customers also and it is not for profit organization. So in this case you will have to get bonus and dividend for any excess profit earned by federal union credit have earned. A federal union credit is controlled by a board of governors who are selected by vote of the members and board members are responsible for running day to day affairs of the federal union credit. These board members are serving on voluntary basis and only one of them gets compensation. The federal union credit has been serving the nation for 74 years now. The number of federal union credit has reached around 8000 with assets of 8 million and serving 90 million people. However its membership is not open for everyone and the members should share some kind of a bond such as association, community or occupation.

Features

The application procedure is simple, first thing is to share common bond provisions, after that he or she has to fill a form for membership and purchase at least one share typically around $5-10. Then they will become members of the federal credit union with full voting rights. Usually the credit unions have permanent membership facility for this purpose a member should also be a permanent member of the family or community. It is also important to note that provincial credit union laws are not applicable on the federal union credits and they can open branch anywhere their members are. In some cases these federal union credits have their branches worldwide.

Comments

Members of US Navy and Marine corps are members of Navy Federal Credit Union. As these corps is stationed outside country so the NFCU has offices across the world to serve the needs of these individual members as part of their community. They are also not disturbed by the credit crisis as the period for customer loans is very short and not affected by the conditions faced by mortgage companies during 2008 financial crisis.

Comments

Most Recent Articles

-

Credit Union Federal Information

Credit unions are always non-profit organizations offering financial services to people. A credit union works much like a bank with a few notable differences. The most obvious difference bet...